Heloc borrowing calculator

How much can you borrow. Our banking specialists are ready to answer your questions and assist you with your borrowing needs.

How To Calculate Equity In Your Home Nextadvisor With Time

If you have a home equity line of credit HELOC repayment operates like a credit card you draw from the line up to the line amount just like the credit limit on your credit card.

. The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. To complete the underwriting for the Piggyback HELOC Rocket Mortgage will leverage the same documents that were used for completing the mortgage loan such as loan application appraisal evaluation credit review etc. Home Equity Loan Calculator Reduce Your Monthly Debt Payments.

You can use a HELOC for just about anything including paying off all or part of your remaining mortgage balance. On FHA loans. A home equity loan term can range.

Citizens Home Equity Line of Credit Debt Consolidation Calculator. Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. A home equity loan lets you borrow against your homes value.

Your HELOC limit can be determined using the loan to value LTV ratio and remaining mortgage balance. Find out your monthly payment and the date your loan will be fully paid off. Input your data into our calculator to compare your estimated payments for a home equity loan vs.

Borrowers are pre-approved for a. With some basic information about your existing or. A Smart Refinance loan is a no-closing-cost mortgage refinance option that lets you take advantage of lower rates get cash out.

Home equity line of credit HELOC calculator. The HELOC repayment is structured in two phases. This calculator does not assure the availability of or your eligibility for any specific product offered by Citizens Bank or its affiliates nor does the calculator predict or guarantee the actual rate.

Going off our earlier example lets say you find a lender whos willing to give you a HELOC with 80 LTV. When you get a HELOC through Prosper your mortgage and HELOC combined can be worth as much as 90 of your homes fair market value. You may apply for a Smart Refinance loan up to.

So you can take advantage of fixed monthly payments and protect yourself from rising interest rates. CLTV is your overall mortgage loan debt expressed as a percentage of your homes fair market value. Once that borrowing period ends youll continue to pay principal and interest on what you.

HELOC Payments How are HELOC repayments structured. Like a mortgage a HELOC is secured by the equity in your home. Free calculators for your every need.

When you have a HELOC you may be charged a small nominal annual fee - say 50 to 100 - to keep the line open but you do not accrue interest until you draw on the line. Rather than borrowing a specific sum of money and repaying it a HELOC gives you a line of credit that lets you borrow money as needed up to a certain limit and repay it over time. Interest rates for a home equity loan are typically lower than interest rates for credit cards or unsecured personal loans.

A home equity line of credit HELOC allows homeowners to borrow funds based on the equity they own in the home. What is the difference between getting a HELOC and a second mortgage. Using a student loan calculator can help you create a student loan repayment strategy thats right for you.

HELOCs are described as having a revolving balance because borrowing multiple times within the account for any amount up to the allowable credit limit does not require writing a new loan document. In large part because you are only borrowing a limited fraction of the homes value. Need to talk to.

Its like having a credit card secured by your home equity. Typically youre only required to make interest payments during the draw period which tends to be 10 to 15 years. Back to top Top.

The APR though is the better comparison point because it represents the total cost of borrowing. Leveraging your homes equity allows you flexibility in how you use the funds for anything from home remodeling to emergency expenses. Lower your monthly payments with a Home Equity Line of Credit HELOC.

Speak with a branch specialist at the branch closest to you. The draw period is the phase. Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future.

A home equity line of credit or HELOC is a special type of home equity loan. Home Equity Line Of Credit - HELOC. Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule.

15000 to 750000 up to 1 million for properties in California. Debt Consolidation Loan Calculator. Results are estimated based on a Smart Refinance loan amount of.

A home equity loan and a home equity line of credit HELOC are ideal for borrowing money when you need it. Your home is worth 250000 and you currently owe 180000. A home equity line of credit HELOC is a line of credit extended to a homeowner that uses the borrowers home as collateral.

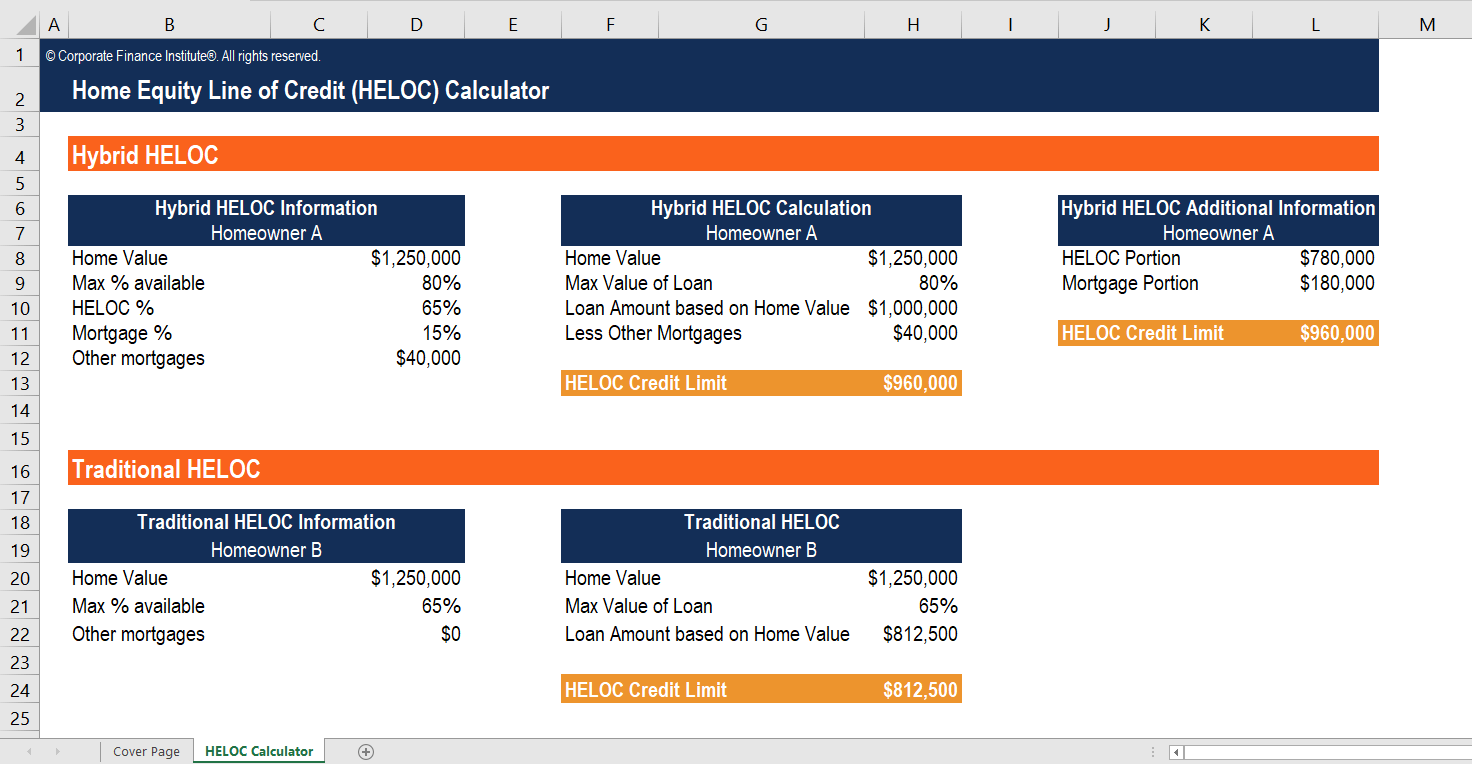

To figure out how much your credit limit would be on this HELOC multiply your homes value by 80 and subtract your current balance. For example say your home is worth 350000 your mortgage balance is 200000 and your lender will allow you to borrow up to 85 of your homes value. Continue to use your home equity line of credit as needed for the duration of your borrowing period usually 10 years.

What is a HELOC. Your actual results may vary. Lower borrowing costs.

Unlike a mortgage a HELOC offers flexibility because you can access your line of credit and pay back what you use just like a credit card. A HELOC on the other hand gives you the flexibility to borrow and pay off the credit whenever you want. 250000 X 80 200000.

Results provided by this calculator are intended for Illustrative purposes only and the accuracy is not guaranteed. The maximum HELOC amount is calculated as 65 loan-to-value of your home as seen in the example calculation above. If your home is worth 100000 and you owe 40000 on your mortgage then your CLTV is 40.

To find the best loan for you compare loan rates with a few lenders before applying. The rate on a Home Equity Line of Credit often is much lower than the rate you are paying for other loans. A Piggyback HELOC is a HELOC that is opened at the same time the home is purchased or refinanced.

While both a HELOC and a second mortgage use your home equity as collateral a second mortgage can offer you access to a higher total borrowing limit at a higher interest.

Heloc Calculator

Home Equity Line Of Credit Qualification Calculator

Heloc Calculator To Calculate Maximum Home Equity Line Of Credit

Tips For Picking A Loan Term For Your Home Mortgage Home Mortgage Mortgage Mortgage Tips

Home Equity Calculator Free Home Equity Loan Calculator For Excel

1

Interested In Borrowing Against Your Home S Available Equity To Pay For Other Expenses The Good News Is You Have Ch Home Equity Line Of Credit Mortgage Payoff

Looking For A Heloc Calculator

Heloc Calculator Calculate Available Home Equity Wowa Ca

1

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

How Much Interest Will I Pay Credit Card Payment How To Calculate Credit Card Payment Creditcard Creditcardpayment Calculation H Heloc Mortgage Debt

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Line Of Credit Heloc Calculator Overview

Home Equity Line Of Credit Heloc Calculator Overview

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Loan Home Equity

Pin On Loan